Patriot Review

What Is Patriot – (Patriot Review)?

Patriot ties for No. 3 in our rating of the Best Payroll Software of 2024. It holds the same position in our Best Payroll Software for Small Businesses, as well as the No. 1 spot in our rating of the Best Cheap Payroll Software.

Patriot’s affordability complements other features to streamline business, like tools for letting you handle payroll, accounting, tax, HR, and more for an unlimited number of full-time company employees or contractors.

Founded in a basement in 1986, Patriot now assists millions of businesses, with a primary focus on United States-based companies. Patriot is currently headquartered in Canton, Ohio.

PATRIOT IS RECOMMENDED FOR:

- Businesses with tighter budgets

- Business owners primarily based in the United States

- Those who prefer the option of upgrading for tax services

PATRIOT ISN’T RECOMMENDED FOR:

- Companies either outside the United States or with employees located abroad

- Those who want payroll, accounting, and HR features automatically bundled

- Larger companies with many employees to manage

Patriot offers two plans, Basic and Full Service. The Basic plan costs $17 per month, while the Full Service plan costs $37 per month. Additionally, Patriot charges $4 per employee entered into the system.

Patriot’s Basic and Full plan fees are likely to be affordable for sole proprietors, small business owners, or anyone with tighter budget constraints. Professional reviewers note that Patriot has an intuitive interface, making it a good option for those who are new to using payroll software.

The Basic tier provides the standard fare for payroll services, including direct deposit, printable checks, and electronic or printable W-2s. This plan also provides a portal where employees can access and print pay stubs, enter time card data, and update their login information.

Meanwhile, the Full Service plan not only provides payroll support, but Patriot will deposit and file federal, state, and local taxes on behalf of your business. Patriot provides a guarantee that your tax forms will always get submitted on time.

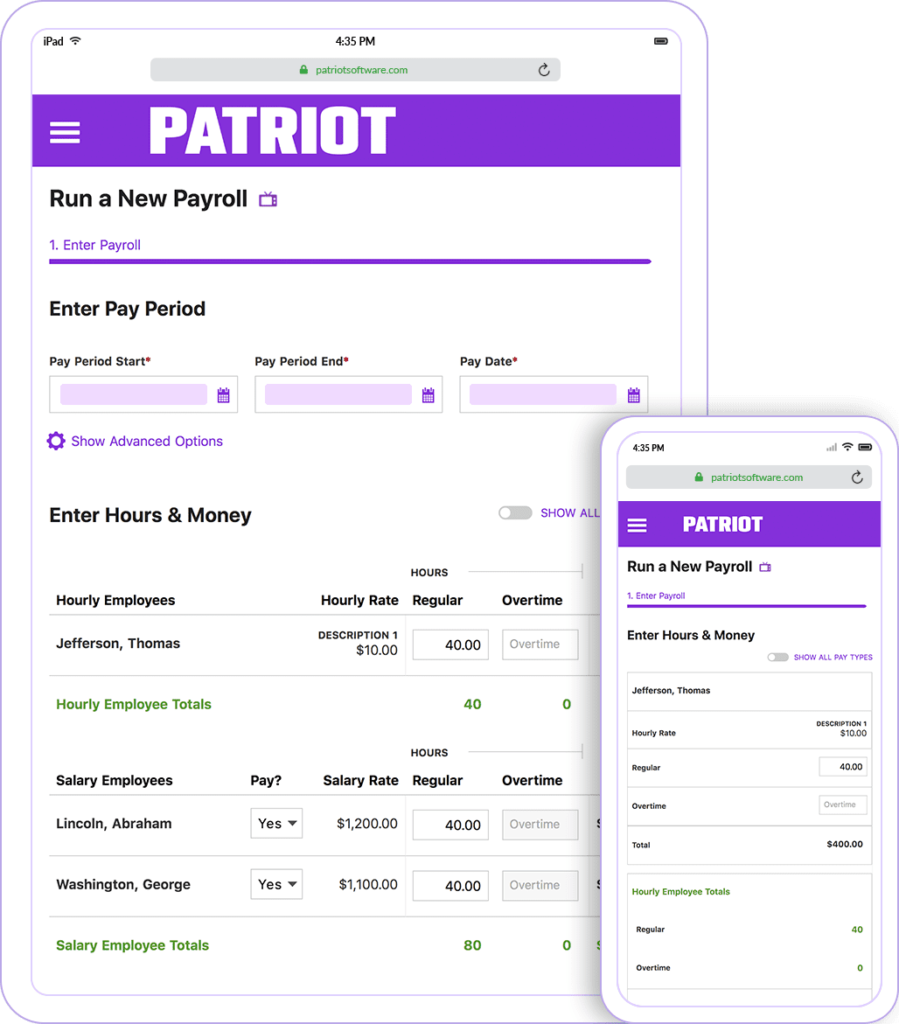

Patriot allows businesses to manage payroll for salaried employees as well as contract workers. You can customize the pay period start and end dates, review employee paycheck details before approval, and print checks. For direct deposit, some qualifying customers can receive a free two-day deposit, making it easier for your employees to get paid faster.

Patriot is designed to let you add and use only the services you need; however, it might not feel as convenient as competing services where support features include tools like employee time and attendance tracking, business accounting, or HR, which may be included under a single payment plan. Moreover, the $4 fee per employee works best if a business is very small; this fee adds up quickly if a business has hundreds or thousands of people on the company payroll.

How Much Does Patriot’s Payroll Software Cost?

With the Basic plan starting at $17 per month, plus a $4 charge per employee, Patriot provides an affordable starter plan for small businesses. Should you upgrade to the Full Service Payroll plan, it begins at $37 per month.

Patriot’s subscription packages may be a good fit for smaller businesses needing robust payroll software despite a tighter budget. Patriot allows for unlimited payrolls that cover regular employees and contractors alike, making it an adaptable option for payroll needs that may change as your company grows.

What Plans Are Available From Patriot?

| PRODUCT | MONTHLY FEE | DIRECT DEPOSIT DAYS | AUTOMATED PAYROLL | AUTOMATED TAX FILING | TIME TRACKING | HR ADD-ONS | PRIORITY SUPPORT |

|---|---|---|---|---|---|---|---|

| Basic | $17.00 & $4/Employee | 2 Days/4 Days | – | – | – | ✅ | ✅ |

| Full Service | $17.00 & $4/Employee | 2 Days/4 Days | – | ✅ | – | ✅ | ✅ |

Patriot offers two service plans for small business customers: Basic and Full Service. Each plan’s features are laid out in more detail below.

Basic:

- Unlimited payrolls

- Employee portal

- Contractor payment options

- Time-off accruals

- Workers’ compensation integration

- Support for businesses with multiple locations

- Customizable deductions, working hours, and currencies

- Two-day direct deposit (for qualified customers)

- Integrations for accounting software

- Time and attendance integration

- 401K integration

- HR Integration

- Digital and printable W-2s

- 1099 e-Filing (optional)

- Multiple pay rates

- Repeating or additional money types

- Payroll costs by department

Price: $17 per month

Full Service:

- Everything in the Basic plan

- Patriot files payroll taxes on your behalf with a tax filing accuracy guarantee

Price: $37 per month

Patriot guarantees that it can handle your tax obligations, getting the necessary documents processed on time and free of any errors.

In addition to the base prices for each service plan, Patriot charges $4 for every employee or contractor your company includes.

How To Buy Patriot Payroll Software

There are a few crucial steps necessary to purchase and use Patriot’s payroll software:

- Sign up for the free trial: To start the trial, sign up for Patriot using your name and email. After answering how you heard about the service, Patriot will send you a confirmation email where you will finish setting up your account.

- Choose a service plan: After creating your account, you need to decide between Patriot’s Basic or Full Service plan. Keep in mind that by upgrading, Patriot will move to process and submit your business’s federal, state, and local tax information on your behalf.

- Set up payroll: Once you select a plan, you are ready to run a payroll. Enter employee information, approve the payroll, and then print checks.

If, after using Patriot for a few weeks, you decide it’s not for you, cancel within 30 days to avoid making a payment.

Patriot vs. the Competition

Patriot vs. OnPay

OnPay offers customers a complete payroll service plan starting at $40 per month and $6 per employee. This makes it slightly more expensive than Patriot’s own Full Service subscription tier, which begins at $37 per month. However, OnPay makes up for the extra cost by bundling in many more services that Patriot’s payroll plans lack, such as HR and paid time off benefits. OnPay offers automated payroll, while Patriot does not.

Although Patriot provides add-ons for its services, it’s not as straightforward as OnPay about pricing. For example, items such as time and attendance integration are mentioned as available in both its service plans but are mentioned in the company’s video demo as add-ons. OnPay’s full-service plan only refers to what gets included.

Patriot, in its own words, is best suited for companies with up to 500 employees. Meanwhile, OnPay’s pricing plan page features a slider that informs you what you would pay each month according to the number of employees your business has, maxing out at 1,000 employees. Therefore, mid-size companies with more robust budgets will likely get more out OnPay, while very small businesses may prefer Patriot.

For more information, check out our full OnPay review.

Patriot vs. Rippling

While Patriot makes its starting costs public, you must contact Rippling directly for a quote, though Rippling does state it starts at $8 per month per user. With regard to location, Rippling’s payroll capabilities are a bit more robust than Patriot’s, letting you set up payroll for employees in the United States and abroad. Patriot is, meanwhile, more focused on supporting small businesses in the States.

Rippling offers a mobile app compatible with Apple and Android phones. Patriot’s software is mobile-friendly and can be used across various devices. Both services allow you to track and provide payroll support for salaried and contract employees.

Patriot’s pricing and simplicity make it ideal for smaller, U.S.-based businesses. Rippling, alternatively, is likely the better option of the two for medium to larger companies operating internationally.

For more information, check out our full Rippling review.

FAQs :

Does Patriot offer a trial period?

Patriot does have a free trial. You can sign up and try it for 30 days. To start the trial, sign up for Patriot using your name and email. Upon signing up and selecting your plan, you’ll be able to make use of Patriot’s payroll features. If, after trying Patriot’s services, you decide that it’s not for you, you’ll need to follow the directions of your specific plan to cancel.

Does Patriot offer direct deposit?

Yes, Patriot offers direct deposit features for both employees and contractors, depositing funds directly into their bank accounts. To make use of the option, your company must have a business or commercial bank account.

Does Patriot offer automated tax filing?

If you upgrade to Patriot’s Full Service plan, Patriot will automatically process and file federal, state, and local taxes on behalf of your business. It also offers a guarantee on this service, stating that documents will be submitted on-time, year after year. Note that this service is part of the upgrade and does not come standard with the Basic plan.